Warren Buffett’s [Not-So] “Secret Sauce”

Leverage. With a mostly negative interest rate!

Dozens of books and thousands of articles have been written about Warren Buffett. Most of them focus almost entirely on his investment strategy (including my The Winning Investment Habits of Warren Buffett & George Soros).

But the criteria he uses to make his investment decisions is only half (or perhaps two thirds) of the story.

The rest of the story is what’s called “float.” As Buffett explains:

Our property/casualty (“P/C”) insurance business has been the engine propelling Berkshire’s growth since 1967, the year we acquired National Indemnity and its sister company, National Fire & Marine, for $8.6 million.

P/C insurers receive premiums upfront and pay claims later. In extreme cases, such as claims arising from exposure to asbestos, or severe workplace accidents, payments can stretch over many decades. Meanwhile, insurers get to invest this float for their own benefit [Emphasis added].[1]

When an insurance company is profitable, that float is, effectively, . . .

“Free” Money

Actually, better than free, as the insurance company’s profit can be classified as a negative rate of interest.

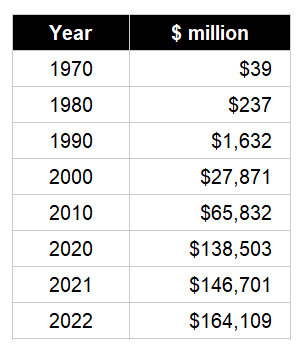

Today, Berkshire Hathaway is the world’s largest insurance company: between 2003 and 2022 its insurance profits totaled $29.2billion. While its total float rose from $39 million in 1970 to $164.109 billion in 2022, as this table shows:

From Buffett’s perspective, he is being paid to sit on that $164.109 billion of float—a stunning 31.17% of Berkshire Hathaway’s total market capitalization of $468.71 billion (as of 30 Dec 2022)—rather than paying interest for its use.

Money Buffett can (and no doubt will) use to add to his investment and business portfolios.

Sad to say, when we want to take advantage of leverage, it usually means going to the bank and paying interest.

So to put Buffett’s “float” advantage into a more meaningful (to us) context, imagine that we could borrow $1,000 a year interest-free. And we use that money to invest in a low-cost index fund.

From the end of 1967, when Buffett purchased National Indemnity, to the end of 2022, the S&P 500 index rose from 95.04 to 4,076.60.

Over those 56 years, our imaginary interest-free $1,000 per year comes to a total of just $56,000.

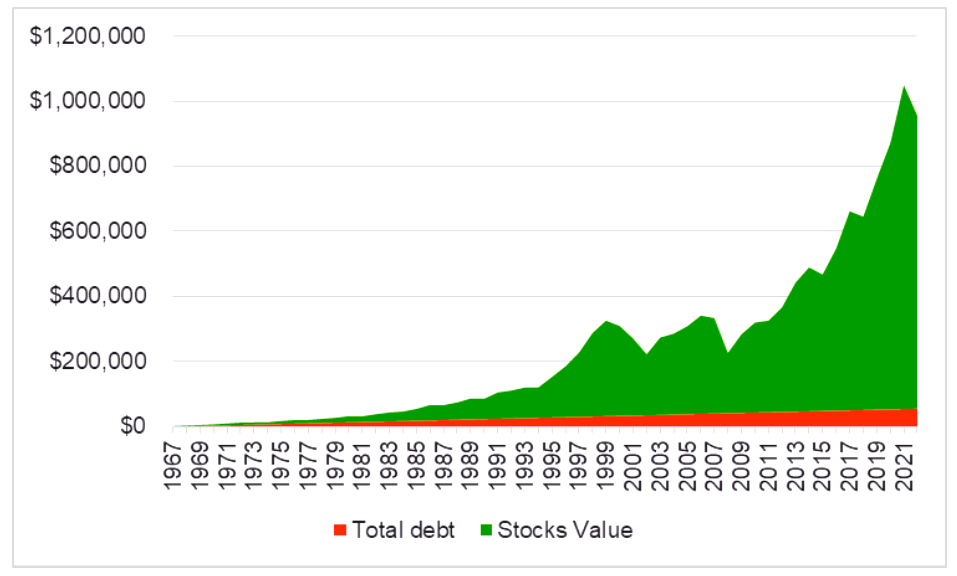

But the value of our index fund investment, as you can see from this picture:

peaks at $994,850.09 at the end of 2021 before dropping back to a not-too-shabby $899,142.17.

We could, of course, easily retire that debt of $56,000 any time we chose. But as it’s interest-free, why would we?

Especially when we consider the return on our “investment”: $56,000 into $899,142.17 works out to be a return of 1,506%! A return which will continue as long as we could borrow interest-free money.

No wonder Warren Buffett loves float.

One of the puzzling and surprising things is that any medium to large business could adopt Buffett’s [not-so] “secret sauce” strategy by purchasing an insurance company.

Hardly any do. Despite the glaringly obvious advantages of following in Buffett’s footsteps.

Harness the Investment Genius of Warren Buffett & George Soros

Discover the Mental Habits and Strategies that

made them the World’s Richest Investors

Warren Buffett and George Soros both started with nothing—and made billion-dollar fortunes solely by investing. Their investment strategies are total opposites—yet they religiously follow exactly the same mental habits and strategies.

Adopt these mental habits yourself and Revolutionize YOUR investment returns